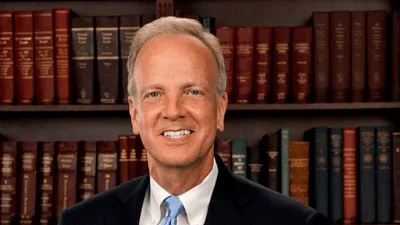

Mark Burghart, Director Department of Revenue | Kansas Department of Revenue

Mark Burghart, Director Department of Revenue | Kansas Department of Revenue

Overall, Kansas collected $2.9 billion in taxes during the third quarter of 2023, compared to $4 billion in the previous quarter.

The majority of the state’s tax revenue was collected through general sales and gross receipts taxes ($1.4 billion) and income taxes ($1.3 billion).

In addition to detailed tax revenue data from each state, the Quarterly Summary of State and Local Government Tax Revenue includes an estimate of state and local government tax revenue at a national level.

The Census Bureau cautions that it sets the tax classifications among the survey categories, and they may differ from the classifications set by the state governments.

| Type of Tax | Amount (millions) |

|---|---|

| Sales and Gross Receipts Taxes | $1,433 |

| Income Taxes | $1,347 |

| License Taxes | $100 |

| Property Taxes | $26 |

| Other Taxes | $4 |

Alerts Sign-up

Alerts Sign-up